ENTERPRISE RISK MANAGEMENT (ERM)

Today’s business environment is rapidly changing. It is creating new areas of growth opportunities, opening up new markets, and bringing new customers. However, as Covid 19 painfully demonstrated, it also creates new and unique risk related challenges which can limit or hamper the ability of small, medium, and large organizations to take full advantage of these opportunities.

Having a holistic approach towards identifying, assessing, and controlling

risk through a formalized Enterprise Risk Management (ERM) process is not

just an added advantage, but a necessity for sustained and profitable

performance. Organizations with a well-defined ERM approach:

- Better understand and address their risk profile which consequently allows them to improve their business performance, and confidently pursue new opportunities.

- Improve their ROI by driving down their total cost of risk and stabilize it over time.

What is ERM and how does it relate to the above-mentioned challenges?

- What’s most likely to hurt us and how often it can happen (frequency)

- How much it can hurt us if it happens (severity)

- What our strategy is to address and prepare for it, on a risk-by-risk basis

A simple process

The ERM process involves a series of six steps when taken in sequence that provides a sustainable framework to identify, evaluate and respond to the hazard, operational, compliance, financial and strategic risks faced at all levels of the organization.

ERM is not:

- A complex, cumbersome, and expensive process

- Solely a function of traditional risk management or the purchasing of insurance

- A process that only larger organizations can utilize

Why is ERM important to every organization?

It helps protect the continuity and balance sheet of the organization.

We can no longer afford not to think about and utilize ERM (Covid 19).

It facilitates the capturing of risk across the organization by removing “silos”.

It helps reduce personal liability of the executive team and/or the board (D&O).

It can help remove uncertainty and create peace of mind for management and stakeholders alike.

It helps to reduce the total cost of risk in terms of:

- Lost productivity

- Reputational damage

- Increased efficiency/ intentionality in the insurance purchasing process (lower insurance premiums, lower claims, insurance broker role optimization, ERM mandate).

Our ERM Practice

ARS specializes in ERM and has been assisting Dutch Caribbean organizations in various industries for over 25 years. We utilize a proven, tailored approach which can include:

Current program review – a review of the current process of managing risk or ERM program, including a measurement against both peer and industry benchmarks as well as the international standard on risk management. We then prepare a “scorecard” which includes:

- a summary of the current state of the risk management or ERM program

- detailed and customized recommendations for sustainable improvements in the risk management or ERM program

- recommended next steps

ERM implementation assistance – we regularly assist organizations in the implementation of ERM from the ground up, helping guide you through the entire project or provide tactical consulting at key junctures.

- Outsourced risk managers – function as the risk manager

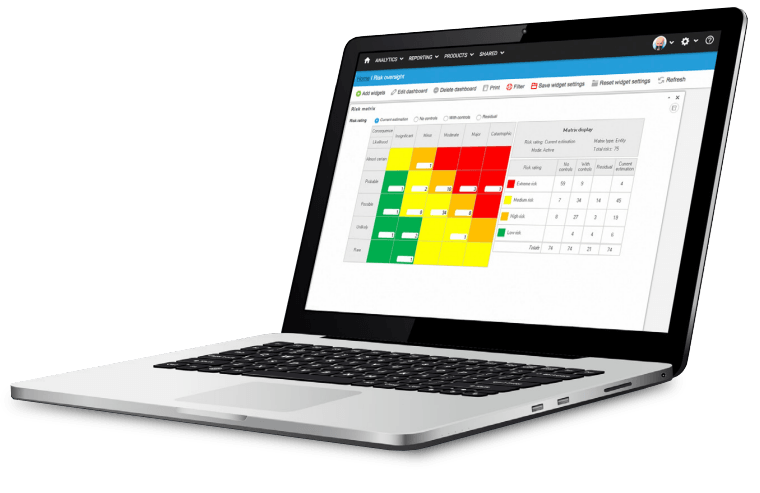

ERM software utilization – assist with evaluation and implementation of online systems that can be utilized to manage risks, keep risk register up to date, facilitate incident response and compliance reporting, and also perform other enterprise risk assessments as needed.

One of the key differentiators of our proven cost effective approach is that it allows our clients to implement and independently maintain the ERM process on a going forward basis, with minimized reliance on external advisors/ consultants.

Risk Management made easy

ARS is an authorized distributor of Risk Wizard, which is a flexible off-the-shelf tool, designed to assess risks, monitor compliance, log incidents and track action plans from any desktop or portable device.

Save time, effort, resources

Easy to upload

Atlas Risk Solutions will upload your existing risk register into the online system.

User friendly

Easy, quick and secure way to store, maintain, add/ remove risks in the cloud.

Low cost fees

Affordable subscriptions lets businesses enjoy the benefits of a risk management tool.

Boost underwriter's confidence

Show robust approach to risk management, which can lower insurance premiums.

Industry tailored

Risk Wizard software tailored by Atlas Risk Solutions with key risks applicable to your industry.

Delivers savings

Save time, effort and free up resources compared to Excel, Word or paper-based systems.

SEE MORE SERVICES:

CURAÇAO

Fokkerweg 6 - P.O. Box 4885

Willemstad

T + 5999 465 7766

ARUBA

L.G. Smith Blvd No. 22

Oranjestad

T + 297 583 8160

BONAIRE

Kaya Industria No. 12, 1st Floor, Unit B

Kralendijk

T + 599 717 7776

ST. MAARTEN

Emmaplein Building #1 Suite A

Philipsburg

T +1 721 542 0216

T +1 721 580 3170

T +1 721 542 0216